tax shield formula cca

The net incremental cash flow is 1350000 75686 present. Salvage Value versus UCC Using the methods described in the pro-forma statements will give incorrect answers when the salvage value differs from its UCC If the asset is depreciated.

What Is The Depreciation Tax Shield The Ultimate Guide 2021

This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

. This is equivalent to the 800000. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Now we have got the complete detailed explanation and answer for everyone who is interested.

2 Third Street Suite 250 Troy New York 12180. As such the shield is 8000000 x 10 x 35 280000. What is tax shield on CCA.

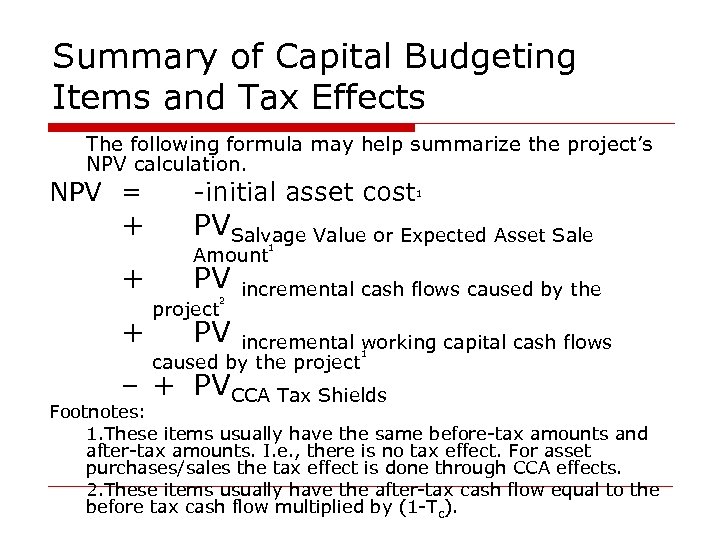

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation. Download View Cca Tax Shield Formula as PDF for free. This is equivalent to the 800000.

The wrong discount rate 11 rather than the hurdle rate of 15 was used in the tax shield formula. All states with corporation taxes use at least one of the following corporation tax income apportionment formulas. Uniform Final Exomination Report TABLE - 1997 125 III A FORMULA FOR.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Formula for cca tax shield. INCOME APPORTIONMENT FORMULAS.

Answer b is correct. As such the shield is 8000000 x 10 x 35 280000. FOR PROFIT CONSTRUCTION CCA-2 1 of 8 INSTRUCTIONS FOR COMPLETING THE NEW YORK STATE VENDOR RESPONSIBILITY QUESTIONNAIRE FOR PROFIT.

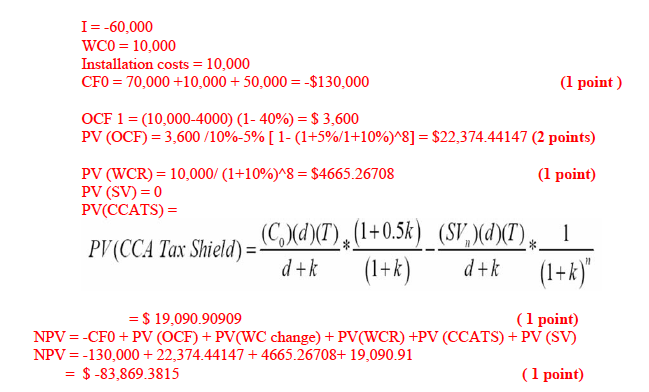

Capital Budgeting Formula Exams Financial Accounting Docsity

How To Npv Tax Shield Salvage Value Youtube

Solved A Firm Is Thinking About Launching A New Brand Of Bicycle The Course Hero

Cca Tax Shield Formula Pdf Public Finance Taxation

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Solved Total Pv Of Cca Tax Shield For Assuming Asset Is Held In Perpetuity Adjusted With One Half Year Rule Pv Of The Lost Tax Shield Pv Of Cca Tax Course Hero

Q 4 6 Points Tax Shield Inc Is Considering A New Chegg Com

Introduction To Corporate Finance Laurence Booth W Sean Cleary Ppt Download

Solved Investment Proposals For Orio Coffee House Investment Proposals Daniel Jackson Ceo Of Och Has Approached You To Work On 2 Investment Proposals That The Company Is Considering Buying Coffee Roaster Plant

Solved Class Cca Rate Description 43 30 Machine And Equipment To Manufacture And Process Goods For Sale Tax Shield Formula Initial Investment X C Course Hero

Semih Yildirim Adms Chapter 8 Using Discounted Cash Flow Analysis Chapter Outline Discount Cash Flows Not Profits Discount Incremental Ppt Download

What Is The Depreciation Tax Shield The Ultimate Guide 2021

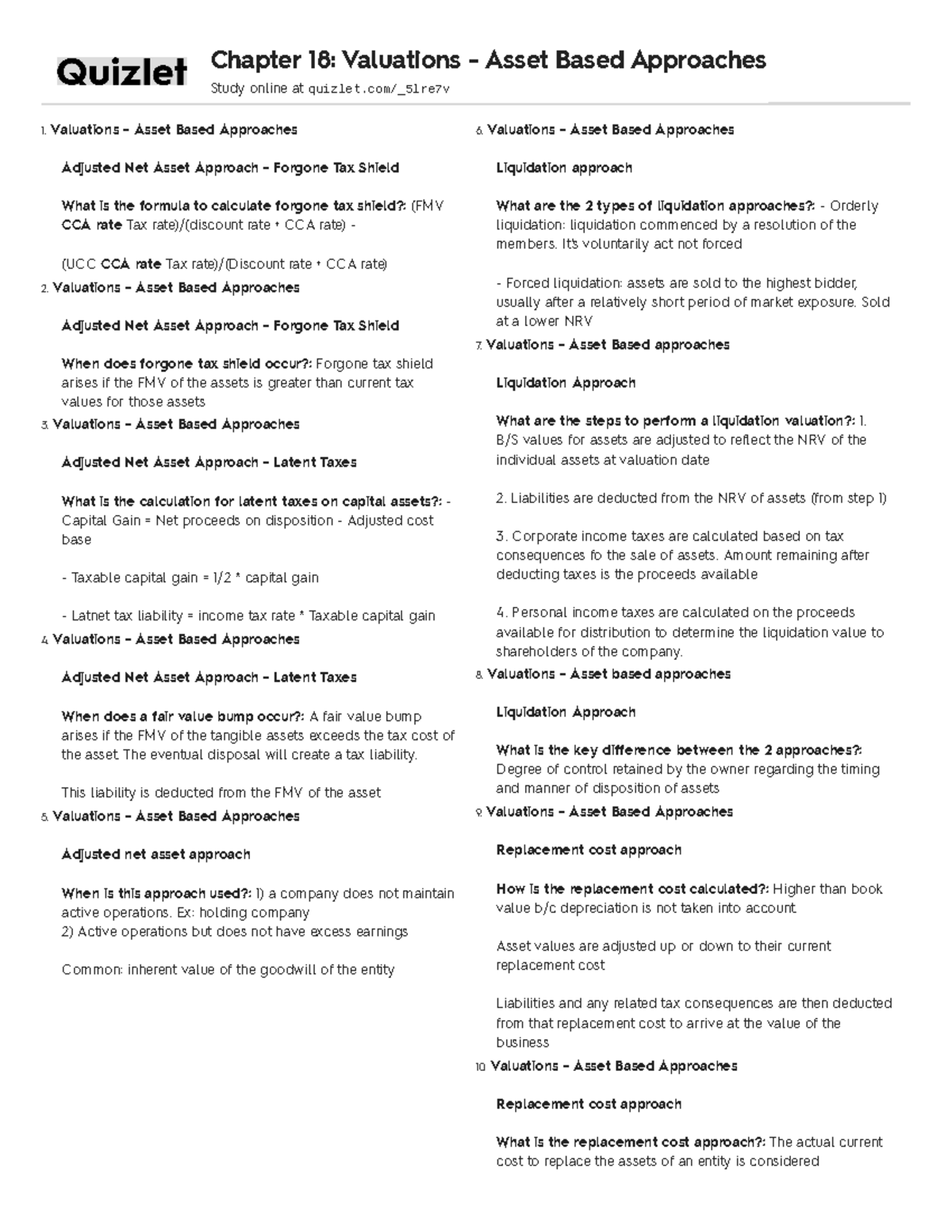

Finance Chapter 18 1 Asset Based Approaches Adjusted Net Asset Approach Forgone Tax Shield Studocu

Capital Budgeting Further Considerations For 9 220

Chapter 10 Making Capital Investment Decisions Prepared By

Solved An Asset Has An Installed Cost Of 1 Million A Life Of 8 Years A Course Hero