main street small business tax credit 1

If credits were received prior for the first version of the mainstreet tax credits they would be included in the. The Main Street Small Business Tax Credit is calculated based on monthly full-time employees.

Credit Card Statement Template Excel Best Templates Ideas

Ad All Major Tax Situations Are Supported for Free.

. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. A Diamond A Dream 3877 N Main St Marion NY 14505 Join us for an educational meet and greet with local business resources such as SBDC SCORE Wayne County IDA and The Better. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Generally these employers may.

If you are a taxpayer or a small business owner and looking for some assistance in tax filing preparation then Stephen Joseph Hanley can be of assistance to you. Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the. We have the experience and knowledge to help you with whatever questions you have.

2022 Homeowner Tax Rebate Credit Amounts. Each employer is limited to no more than 100000 of this credit. Ad Talk to a 1-800Accountant Small Business Tax expert.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Get the tax answers you need. Funding for the Small Business Hiring Tax Credit program totals 100 million and is to be allocated to qualified California small business employers.

In order to determine the net. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality. You will be able to apply your credits against your sales and use tax liabilities for reporting periods starting with.

Ad Connect With A Self-Employment Tax Expert To Help You File Your Taxes Or Do Them For You. 2021 Main Street Small Business Tax Credit II CDTFA CAgov Your tentative credit amount under. Real Estate Development - Tax ExemptionsTax Credits.

How to Claim File your income tax return. Get the tax answers you need. The cap on the credit is 150000 for each qualified small business employer.

City of Buffalo 485-a Tax Exemption is a declining 12-year partial exemption from real property taxes for non-residential real property. Credit Amount For California Main Street Small Business Tax Credit The amount is 1000 for each net increase in the qualified employees measured after the monthly full-time. If your business is eligible for the tax credit you will receive 1000 per net employee hired during July 1 2020 through November 30 2020.

We have the experience and knowledge to help you with whatever questions you have. What is the maximum amount of credit allowed per each qualified small. File your income tax return.

For an employer to qualify for the credit the qualified small. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. If the check amount.

Free means free and IRS e-file is included. Provide the confirmation number received from CDTFA on your. Start Your Tax Return Today.

The amount of credit available for the California Main Street Small Business Tax Credit program was capped at 100000000. Ad Talk to a 1-800Accountant Small Business Tax expert. Employers that have increased hiring since the base period April 1 2020 to June 30 2020.

The California legislature authorized another round of funding for the Main Street Hiring Credit. Max refund is guaranteed and 100 accurate. Your Main Street Small Business Tax Credit will be available on April 1 2021.

Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the credit. Your Main Street Small Business Tax Credit will be available on April 1 2021.

J K Lasser S Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line Wiley

Give Us A Call 612 440 8651 Send Us A Message Info Abdulghaffar Com Opening Hours Mon Friday 8am 5p Bookkeeping Services Accounting Services Bookkeeping

Do You Have To Pay Quarterly Taxes Small Business Expenses Laundry Bag American Made

Small Business Saturday Shop Small American Express Open Small Business Saturday Small Business Small Shop

Five Easy Steps For Enrolling In The Small Business Health Options Program Health Options How To Plan Health

Pin By Corey On Checks In 2022 Credit Card App Business Checks 16th Birthday Wishes

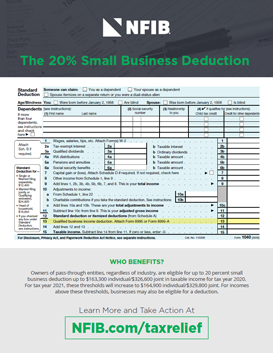

Tax Reform For Small Businesses Nfib

Tax Reform For Small Businesses Nfib

Vintage Radios Historical News Poster Antique Poster Etsy Vintage Radio Radio Historical News

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

How To Get A Business Mileage Tax Deduction Small Business Sarah Tax Deductions Business Tax Deductions Business Tax

Quicken Home Business Personal Finance 1 Year Subscription Windows Digital Personal Finance Business Tax Deductions Business Credit Cards

Fillable Form 1040x 2017 Lesson Tax Forms Health Care Coverage

Taxes Can Be Very Complex And Smallbusinesses Often Run Into Difficulties When It Comes To Knowing All That They Nee Tax Time Payroll Taxes Business Expense

How To Do Holiday Marketing Campaign On A Budget Imperfect Concepts Tax Write Offs Small Business Tax Business Tax

Workers Compensation Audit In Norcross Business Tax Audit General Liability

5 338 Likes 231 Comments Black Wall St Blackwall St On Instagram Need A Tip To Begin Money Management Advice Money Saving Strategies Budgeting Money

Invoice Template Editable Invoice Template Excel Automatic Etsy Invoice Template Bookkeeping Templates Small Business Bookkeeping